FACTORITY

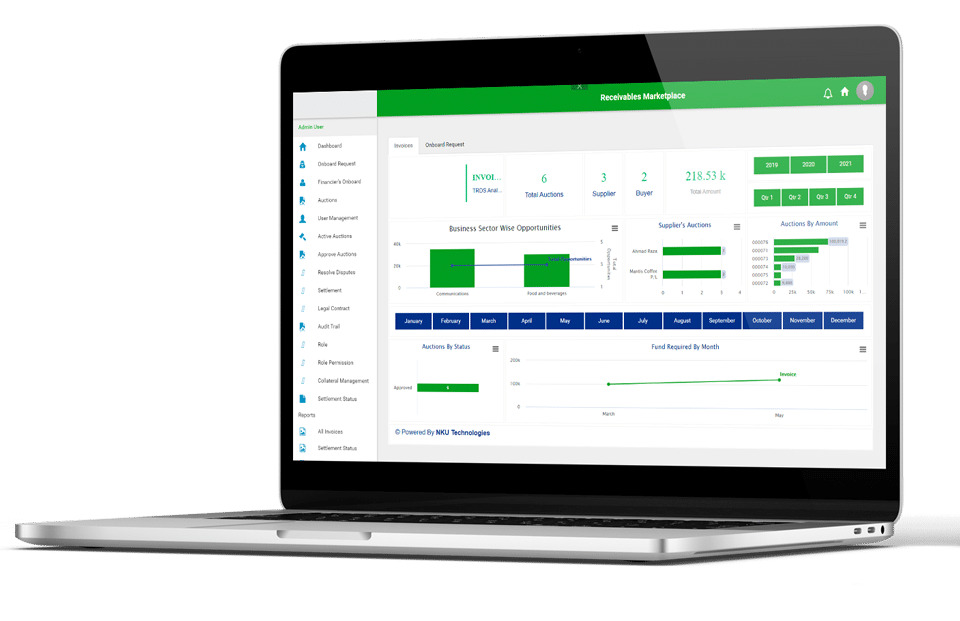

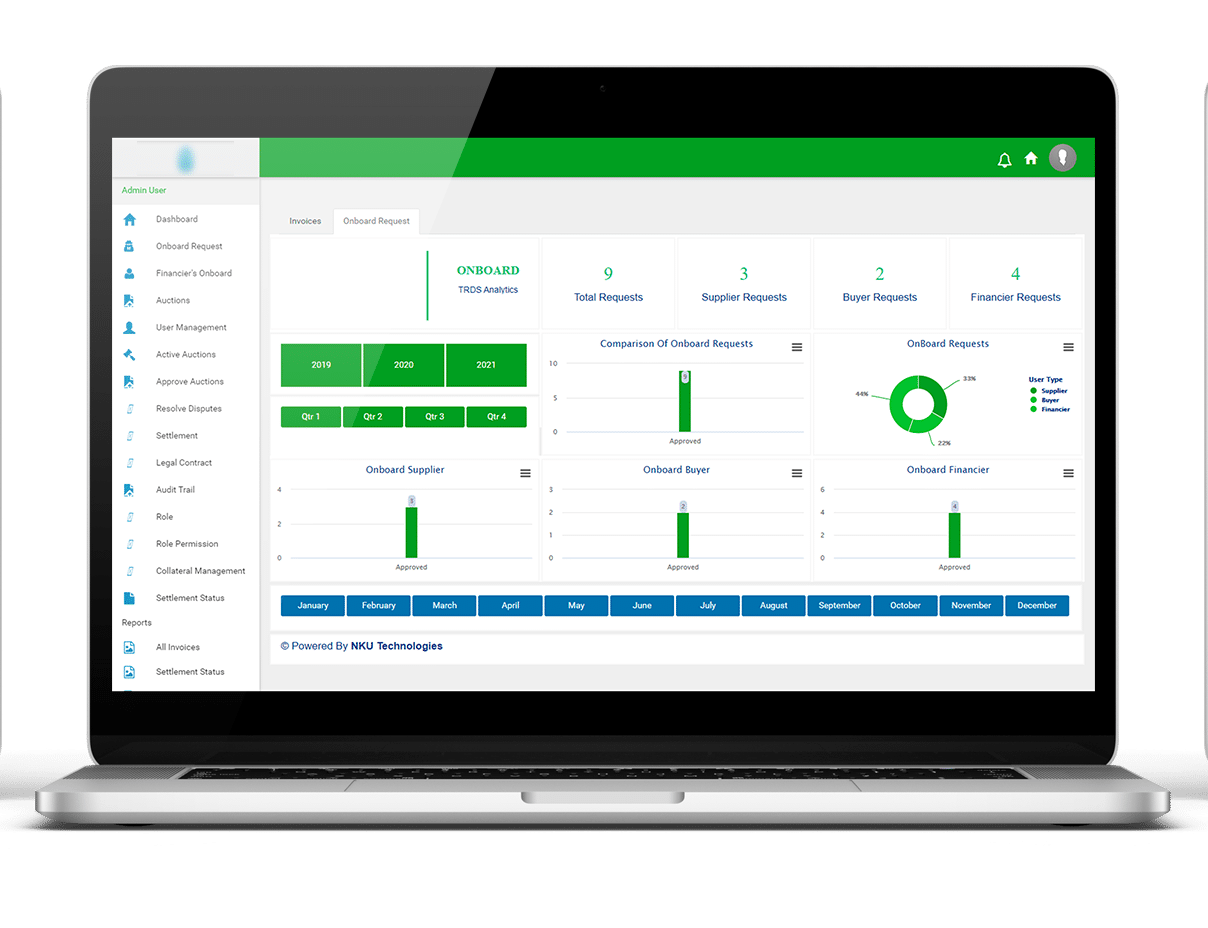

Trade Receivables Discounting Platform

Factority Empowering SMEs through improved financial access for economy boosting.

Why choose FACTORITY?

Small and Medium enterprises continue to face constraints in obtaining adequate operating finance. Factority is an institutional platform to facilitate the trade receivable financing of SMEs from corporate buyers, through competitive bidding by financiers.

Transaction Standardization

Transaction over the exchange are standardized and structures, result in a true sale of the receivable exchange.

Balance Sheet Benefits

Standardized transactions result in better exchange offering balance sheet benefits to sellers and attractive risk adjusted.

Quick Funds Disposal

Using single window operations make funds available and at your disposal quickly rather than being tied up in invoices and processes.

Flexible Contracts

Alleviates the hassle of chasing unpaid invoices and risk of bad debt with flexible contract arrangements.

Smart Funds Management

Reduce hassle, free up funds and time, allowing you to focus on your core business and not trade payments and procedures.

Payment Channels Interfacing

Seamless integration with payment channels for smooth and swift transfer of funds without any manual interventions.

Benefits of Factority

Factority is a digital transformation experience for SMEs and Financiers for providing operating finance efficiently with confidence.

A one stop shop for financiers to invest against pre-approved receivables of authorized suppliers on boarded through re-qualification criteria.

Benefits for Buyers

- Receive Goods on time

- Get Services on Time

- No Delayed Deliveries

- Improved Vendor Relations

- Efficient Cash Flows

- Raise Funds Repeatedly

Benefits for Sellers

- No Irregular Cash Flows

- Faster Realization of Invoices

- Better Receivables Cycle

- One-Time Onboarding

- Simplify Qualification

- Lower Financing Costs

Benefits for Financiers

- Electronic Transactions

- Funds through Auctions

- Central KYC Process

- Centralized Platform

- Wider Access to Customer Base

- Enhanced Confidence in Market

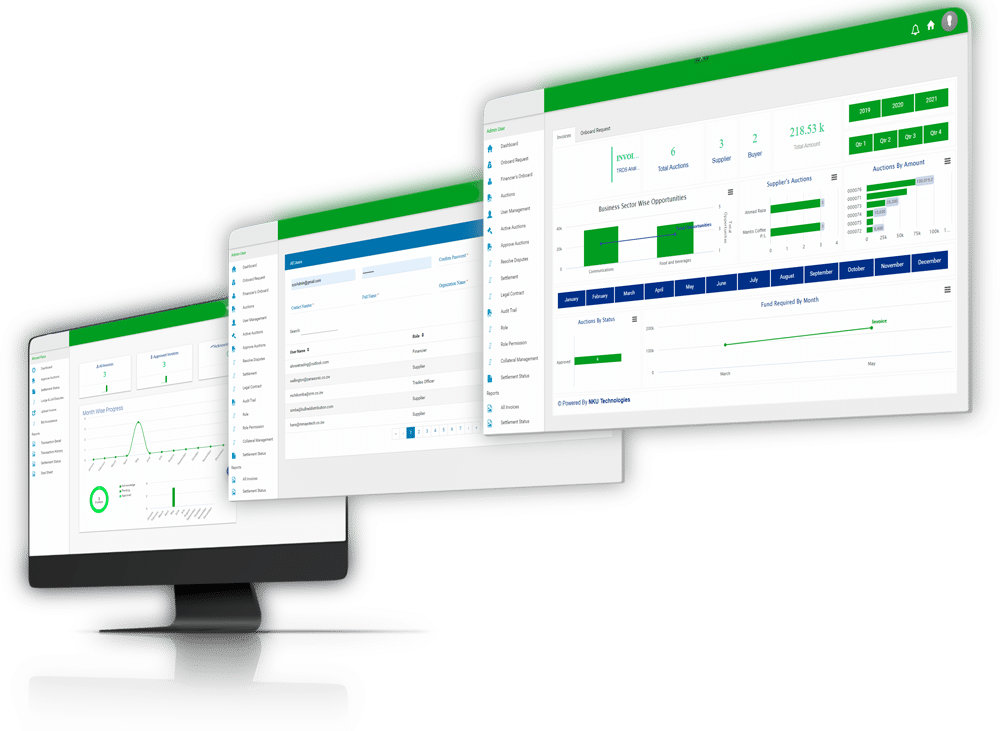

Factority - Improved Financial Access to SMEs

Interested in Factority?

Schedule a Demo

Learn how Factority® can simplify your trade operations, give you access to wider customer base and free up cash flows and make things efficient for all players involved.